Taxes are a mess, right? Every year, like many Americans, I file my return, cross my fingers for a refund, and wonder why my paycheck’s already half gone. Most folks are in the same boat—we do not understand how taxes work, just that they sting. A while back, I stumbled across this idea called Georgism and it flipped how I see the whole system. The system Georgism proposes is not perfect, but it is a heck of a lot better than what we have currently.

Here is the deal: our tax system hammers people who work hard but goes easy on those cashing in on stocks or land. I want to share what I learned through three imaginary folks—Larry, Carol, and Randy—and why this old idea from a guy named Henry George could shake things up. This is not a college economics lecture; it is just me laying out what I found with some simple examples.

1. The Tax System Hits Workers Hardest

I used to think taxes were just taxes—everybody pays their share, right? Wrong. The system is rigged, and once you peek at the math, it is glaringly obvious. Let us meet three people and break down exactly how their taxes add up to see who is getting slammed.

Meet my made-up crew:

Labor Larry: A coder pulling in $100,000 a year, working late, taxed on every penny.

Capital Carol: An investor making $100,000 from stock sales, living in Florida where state taxes do not touch her gains.

Real Estate Randy: A landlord earning $100,000 from a $1,000,000 apartment complex, dodging taxes with deductions.

To keep it simple, they all own a $300,000 home (half land, half house: $150,000 each) with a 1% property tax. Randy has his complex too ($1,000,000; $500,000 land). I am using 2025 tax rates, and they are all single filers, taking the standard deduction ($14,600).

Here is how their taxes shake out:

Larry’s Taxes

Larry earns $100,000 coding in a state with a 5% income tax, like Pennsylvania.

Federal Income Tax: Start with $100,000, subtract the $14,600 standard deduction, so taxable income is $85,400. For 2025, the first $11,600 is taxed at 10% ($1,160). The next chunk up to $47,150 at 12% is $35,550, so $4,266. The rest, $38,250, at 22% is $8,407. Add it up: $1,160 + $4,266 + $8,407 = $13,833.

Payroll Taxes: Social Security takes 6.2% of $100,000 ($6,200). Medicare takes 1.45% ($1,450). Total: $7,650.

State Income Tax: 5% on $85,400 (after deduction) is $4,270.

Property Tax: 1% of his $300,000 home is $3,000.

Total: $13,833 + $7,650 + $4,270 + $3,000 = $28,753 (28.8%).

Larry’s losing almost a third of his pay. All that hard work, and he’s taxed like he’s printing money!

Carol’s Taxes

Carol makes $100,000 selling stocks held over a year, living in Florida (no state income tax).

Federal Capital Gains Tax: After the $14,600 deduction, her taxable income is $85,400. Long-term capital gains up to $47,025 are taxed at 0%—free! The rest, $38,375, at 15% is $5,756. Total: $5,756.

Payroll Taxes: Capital gains skip Social Security and Medicare taxes, so $0.

State Income Tax: Florida has none, so $0.

Property Tax: 1% of her $300,000 home is $3,000.

Total: $5,756 + $0 + $0 + $3,000 = $8,756 (8.8%).

Carol’s paying under 9% because half her gains are untaxed, and she dodges extra taxes. She’s practically getting a thank-you note from the IRS.

Randy’s Taxes

Randy pulls $100,000 renting his apartment complex.

Net Rental Income: He starts with $100,000 but deducts $30,000 (mortgage interest), $10,000 (complex property tax), $18,182 (depreciation), and $23,000 (repairs, utilities, management). That is $81,182 in deductions, leaving $100,000 – $81,182 = $18,818.

Taxable Income: Subtract the $14,600 deduction, so $18,818 – $14,600 = $4,218.

Federal Tax: $4,218 at 10% is $422.

State Tax: $4,218 at 5% is $211.

Payroll Tax: Rental income skips these, so $0.

Property Tax: 1% of $1,000,000 complex ($10,000) plus 1% of $300,000 home ($3,000) is $13,000.

Total: $422 + $211 + $13,000 = $13,633 (13.6%).

Randy’s deductions make his income look tiny, so his taxes are low, even though his land’s value grows from stuff like new coffee shops he didn’t build.

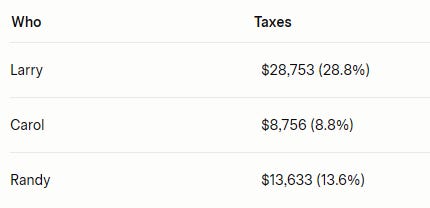

Here is the scoreboard:

The math does not lie: Larry’s getting crushed for working hard. Carol’s coasting with her stocks, and Randy’s playing the landlord game with tax tricks. That is the system—work gets taxed to death, but stocks and real estate get a high-five.

2. Georgism Levels the Playing Field

I was frustrated learning this, but then I found Georgism, an idea from Henry George in the 1800s. It is simple: stop taxing people for working or investing, and tax the value of land instead—the dirt and location nobody made but everybody wants.

We must make land common property, by taxing its value, not the labor or improvements upon it.

Henry George

A Land Value Tax (LVT) hits just the land’s worth—say, the extra value from being near a new park or train station. Unlike today’s property tax, which taxes both land and buildings, LVT ignores improvements like houses or apartments. If Randy builds a fancier complex, his tax stays the same, encouraging development. If he sits on empty land, he still pays, so hoarding prime spots gets pricey. The tax captures the value from public stuff—think schools, roads, or hip neighborhoods—that boosts land prices, not the owner’s effort.

Here is how their taxes shake out with Georgism, replacing most taxes with a 5% flat income tax and an LVT set at 80% of the land’s annual rental value (roughly 5% of its market value):

Larry’s Taxes

Larry earns $100,000 coding and owns his $300,000 home ($150,000 land).

LVT: His home’s land is worth $150,000. The annual rental value is 5% of that: $150,000 × 0.05 = $7,500. The LVT takes 80% of that: $7,500 × 0.8 = $6,000.

Income Tax: A flat 5% on his $100,000 income is $100,000 × 0.05 = $5,000.

Total: $6,000 + $5,000 = $11,000 (11%).

Larry’s work isn’t punished anymore. His taxes drop, and he keeps more of his hard-earned cash.

Carol’s Taxes

Carol makes $100,000 from stocks and owns her $300,000 home ($150,000 land).

LVT: Her home’s land is worth $150,000. Rental value: $150,000 × 0.05 = $7,500. LVT: $7,500 × 0.8 = $6,000.

Income Tax: 5% on her $100,000 stock gains is $100,000 × 0.05 = $5,000.

Total: $6,000 + $5,000 = $11,000 (11%).

Carol’s tax-free stock perk is gone. She pays the same as Larry, so investing isn’t a free ride anymore.

Randy’s Taxes

Randy earns $100,000 renting his $1,000,000 complex ($500,000 land) and owns his $300,000 home ($150,000 land).

LVT: The complex’s land is $500,000, so rental value is $500,000 × 0.05 = $25,000. LVT: $25,000 × 0.8 = $20,000. The home’s land is $150,000, so $150,000 × 0.05 = $7,500, and $7,500 × 0.8 = $6,000. Total LVT: $20,000 + $6,000 = $26,000.

Income Tax: 5% on his $100,000 rental income is $100,000 × 0.05 = $5,000.

Total: $26,000 + $5,000 = $31,000 (31%).

Randy’s bill jumps because his land—especially that prime complex—hogs public value like transit or shops. He’s pushed to build more, not sit on it.

Here is the scoreboard:

Georgism makes taxes fairer. Larry and Carol pay the same, so work is not punished compared to investing. Randy’s big land holdings mean a bigger bill, reflecting the public value he is using. See how the taxes are taken off Labor Larry’s back and saves nearly $18,000?

3. The Citizen’s Dividend Could Share the Wealth (But It Is Tricky)

Georgism has this neat bonus: a citizen’s dividend. Some of the LVT cash gets sent to everyone as a check, so we all share the land’s value. Thomas Paine, author of the Common Sense pamphlet that sparked the American Revolution, pitched something like this in 1797, saying land’s a shared resource. Alaska does it with public oil money—sending over $1,700 per person in 2024. For Larry, Carol, and Randy, this could cut their taxes or pad their wallets.

The catch: back in George’s day, the federal government was small. Today, with federal deficits in the trillions, a dividend is tough to pull off. The government’s burning cash on programs, so extra checks are not likely. Still, it is a cool idea showing Georgism’s about fairness, not just taxes.

4. Why Georgism’s Worth a Look

Georgism could make taxes fairer, push landowners to build, and fund public stuff like parks and infastructure, leaving more cash for savings or startups. Big names ranging from Adam Smith to Milton Friedman haved backed this idea.

"There's a sense in which all taxes are antagonistic to free enterprise – and yet we need taxes. ...So the question is, which are the least bad taxes? In my opinion the least bad tax is the property tax on the unimproved value of land, the Henry George argument of many, many years ago."

Milton Friedman

Winston Churchill and novelist Leo Tolstoy were fans, seeing it as a way to reduce inequality. Modern economists like Joseph Stiglitz say it could fix housing market messes. It is not a wacky theory—it has legs.

Wrapping Up: You Can Get This

Our tax system’s unfair—Larry’s slogging while Carol and Randy coast. Georgism flips that, taxing land, not effort. Changing this will not be easy. Most folks do not care about how the tax system is designed, and the rich who benefit prefer it that way.

But you do not need to be a tax nerd to see the problem. Understanding is the first step to fixing a broken system. I am rooting for you to spot a better way.

If you want to read more about Georgism, you can check out the original book, Progress and Proverty, or check out the Wikipedia article.

Credits: Grok AI helped me immensely to flesh this all out. ChatGPT made the image of Larry, Carol, and Randy.